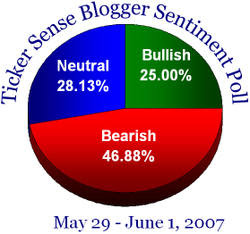

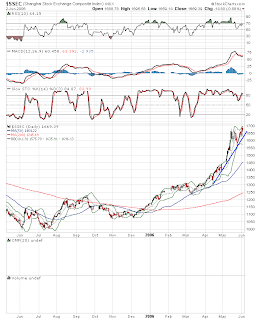

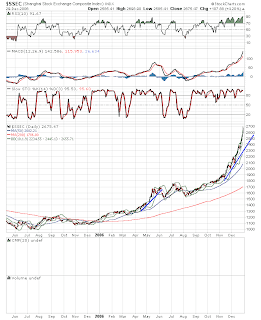

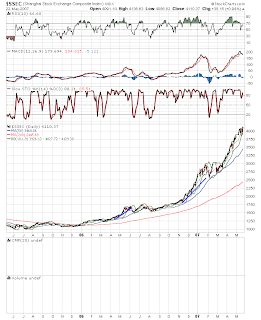

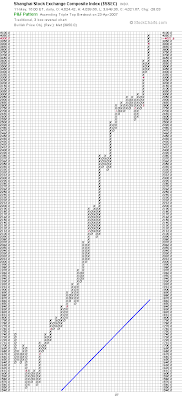

We have all been hearing lately how the Chinese stock market is in a bubble and ready to collapse any day. Seems everyone is in agreement right? However when you actually think about this a bit a few things don't add up. First off when have we ever had a bubble where everyone knew it was a bubble? In 99 & 00 the vast majority of investors were convinced that we had entered a new paradigm. All that mattered was how many eyeballs saw your website, the money would come, the world had entered a permanently high level of economic bliss, etc. etc. Now lets progress to the real estate bubble. At the top in the summer of 05 we were hearing all kinds of excuses for why the real estate boom was not a bubble, from a scarcity of land (Cramer) to the good old cliche "well real estate never goes down" blah, blah, blah. What I'm trying to get across is that bubbles are characterized by mass denial and ludicrous reasoning for why the bubble is in fact not a bubble. That's not happening yet with China. Everyone seems to agree that it

is a bubble. Now lets go back to 99-2000. About half the population was buying tech stocks. The public was in, big time. Same thing for real estate. Everybody buying, multiple houses. ARMS, option ARMS, what ever it took just buy. So recently we've been hearing stories of China opening 300,000 brokerage accounts a day. 2.7 million more accounts opened in 06 than 05. Whew the public is in big time right? Lets say even if China opened 300,000 for every day of this year and we add on the 2.7 million from last year and lets give them 10 million already existing. That means the public in China has roughly 55 million active retail brokerage accounts. Wait a minute the population of China is 1.3 billion, that's billion with a B. That means a whopping 4.2% of the population is now into the stock market. It's definitely heading in the right direction but still a far cry from the 50% that has characterized most of the bubbles throughout history. There just may be a ways to go yet if a really significant portion of the population enters into the fray.

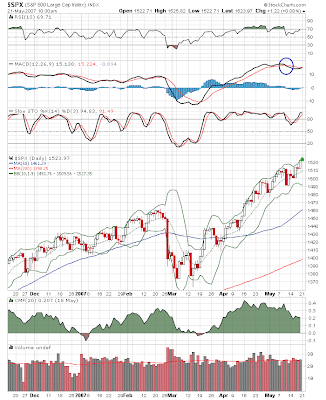

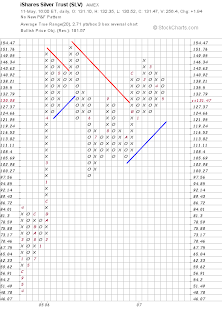

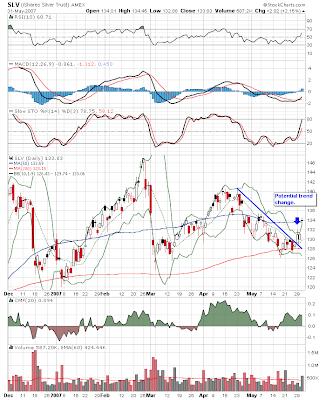

Just as you can use a break in the trendline as a sell signal you can also use it as a buy signal. In the first chart you can see where silver broke the trendline. Coupled with this weeks very bullish COT report for silver. This looks like a pretty good setup to buy or add to (if you're already a precious metals investor) your silver position. In the second chart you can see the same signal for the PM miners. One thing to take notice of is the large % move in the HUI. Normally the mining stocks will lead a move up in the metals and thats exactly what's happening today. I've also pointed out a great example of a 2b reversal on the HUI chart.

Just as you can use a break in the trendline as a sell signal you can also use it as a buy signal. In the first chart you can see where silver broke the trendline. Coupled with this weeks very bullish COT report for silver. This looks like a pretty good setup to buy or add to (if you're already a precious metals investor) your silver position. In the second chart you can see the same signal for the PM miners. One thing to take notice of is the large % move in the HUI. Normally the mining stocks will lead a move up in the metals and thats exactly what's happening today. I've also pointed out a great example of a 2b reversal on the HUI chart.