Emotions. We humans are blessed with them. Of course on the flip side we investors are cursed with them. Fear and greed. The two emotions that make the markets go round. Emotions were put on full display week before last, at least the fear emotion. This week the greed emotion started to come back or maybe it was just his younger brother Hope.

Ever notice how easily these two can change places in your brain? Heck sometimes they can flip flop back and forth several times a day. Now look back at some of your past trades and notice how many times these two emotions made you take the wrong trade. I've said several times over the last week that we should be getting a pullback. So far it hasn't happened, but it will since nothing goes straight up. Right now greed is feeling pretty good but I guarantee that as soon as we have one down day fear is going to jump right back on your head and greed and hope will go right out the window.

So how do we control these little devils that make us act irrationally? In case anyone hasn't noticed irrational behavior isn't real good for your portfolio.

There are a couple of ways. First and foremost we trade with correct position size and we expect the worst. That way if a trade does go against us we don't have so much at risk that if it hits our stops it will do serious damage. If you know ahead of time that even if the worst happens you're not going to lose most of your life savings then it is much easier to keep your head when everyone else is losing theirs. (I got news for you when everybody else is losing their cool that just means they're going to do something stupid and hell if they're going to do something stupid you might as well profit from it) However if you are one of the sheep running with the herd then you're not in any position to take advantage of anything. As a matter of fact your probably to busy getting fleeced.

The second thing we can do is learn discipline. That means when you've got the odds in your favor then play them. Ever heard a pit boss at a casino ask a blackjack player to leave the table just because he's on a lucky streak? Hell no. In fact what happens is that player will start getting all kinds of comps. Now why would the casino do that you ask. He's taking their money. Well obviously the casino knows that the odds are in their favor so all they have to do is keep that player there and eventually the odds will "fix" that little winning streak. It's exactly the same with investing. As long as you trade with the odds in your favor they will eventually "fix" any losing streak. That is as long as you believe me about rule #1.

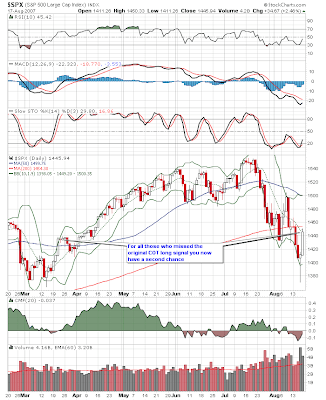

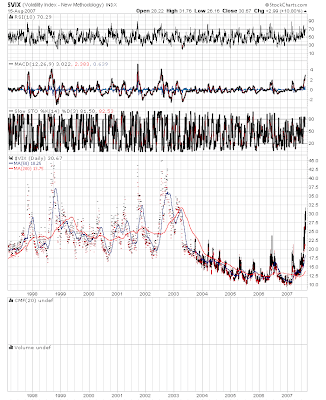

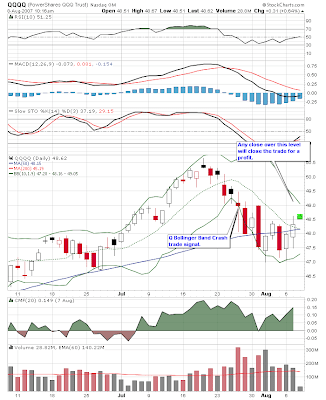

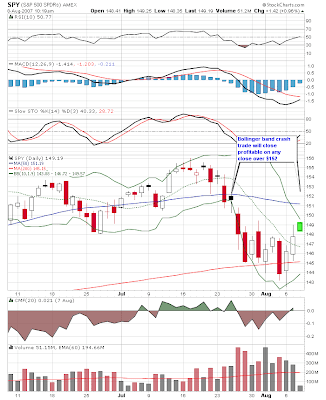

Now trading with the odds can mean many different things. There are probably 1000's of ways to make money in the markets. I've posted the three that I've found work the best COT,

VTO and

Bollinger Band crash trade. All three have a positive expectancy and if consistently traded with discipline and correct position size will produce a long term gain for your portfolio. That's not to say there aren't other systems that will do as good or better. I'm all ears if anyone wants to post their systems BTW. However for these systems to work you've got to take the trades when they setup. You've got to have the discipline to stick with them and you've got to be willing to take a loss since no one knows before hand whether a trade will be a winner or a loser. If you're not willing to let the trade work then you will cut your profits short. All trades have some BIG winners. If you are nervous and take your profits too soon then you will never allow a trade to produce a big winner. By so doing you usually change a positive expectancy into a negative one.

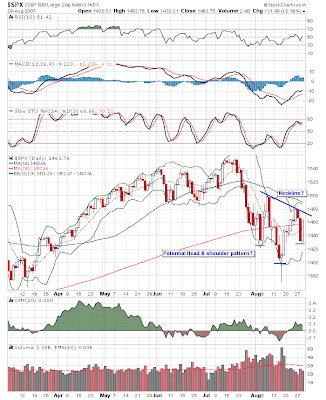

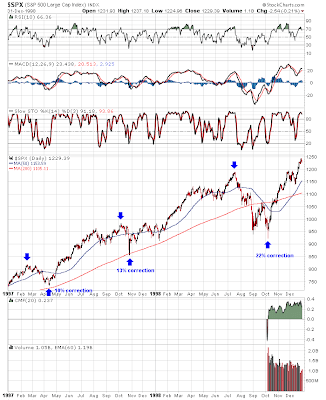

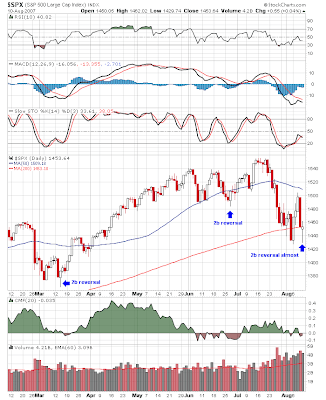

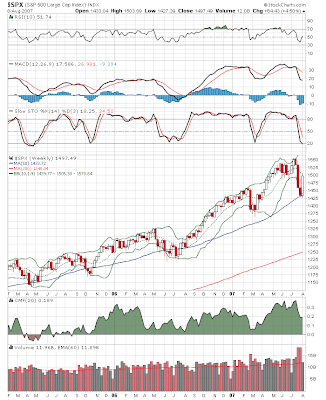

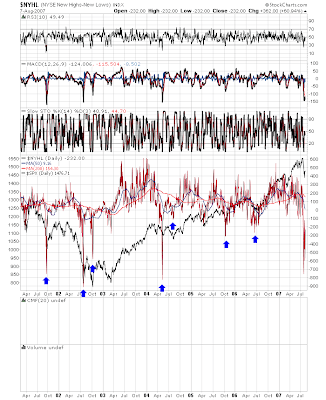

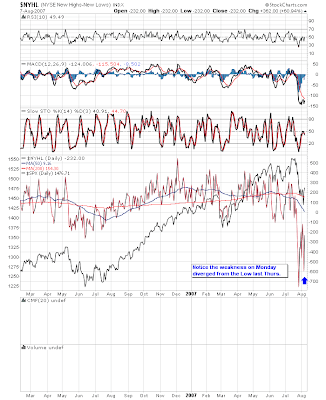

I will be watching the close on the NYSE today. If it can close above 9600 it will have completed a trend reversal according to Victor Sperandeos 1-2-3 reversal rules. If so the test of the lows at #2 was very weak. If that's all the test we're going to get out of this correction then this is one very powerful bull market IMO. We'll have to see how the market closes.

I will be watching the close on the NYSE today. If it can close above 9600 it will have completed a trend reversal according to Victor Sperandeos 1-2-3 reversal rules. If so the test of the lows at #2 was very weak. If that's all the test we're going to get out of this correction then this is one very powerful bull market IMO. We'll have to see how the market closes.