Today I'm going to print an excerpt from last nights report. I think it's appropriate right now.

"At this point I think it’s probably time to talk about taxes. As far as I can remember I’ve never really discussed the topic of taxes but that doesn’t mean it’s not an important one. I think you will see by the time I’m finished that it is a very important one.

Let’s jump in by creating two fictional characters Moe Ronn and John I. Que. They both believe the Dow:gold ratio is heading down and want to invest in the precious metals bull market. However, they go about it in very different ways.

Moe wants to trade mining stocks over the next several years. He has a stake of $500,000. He jumps in and out of trades making up to 1000 trades per year. Sounds impossible doesn’t it? But I guarantee there are many traders that do that or even 5 times that amount in a year. Right off the bat you are throwing away, conservatively, $7,000 to $35,000 to your broker. (There’s nothing I hate more than making my broker rich)

Now let’s say Moe manages to turn a profit with all of this trading of say $50,000 (hey it is a bull market and hopefully even Moe can make money in raging bull market). Now lets say Moe has other income that put him in the 33% tax bracket. Moe’s $50,000 is going to turn into roughly $33,000. So Moe turned his $500,000 into $527,000 after taxes and broker fees the first year by trading like a banshee.

Now while Moe was frantically jumping in and out of the market John bought a basket of undervalued miners, stuck them in a separate account and forgot about them. John paid his broker conservatively $70- $100. At the end of the year John’s account is up 100% (impossible you say. Take a look at mining stocks and juniors for the last several months)

At the end of the year John doesn’t pay any taxes on his gains because he hasn’t taken them yet. So John turned $500,000 into $1,000,000 (minus the $70-$100 brokerage fees. John’s broker doesn’t like him very much, by the way).

The next year Moe continues his frantic trading regimen again managing to eke out a 10% gain. After taxes and broker fees his account has grown to roughly $555,000.

John is still holding but this time he’s up conservatively 200% (the gold bull is really kicking into high gear now) So his $1,000,000 is now $3,000,000. No broker fees this year.

Keep in mind that while Moe is sitting in front of his computer every day with a bottle of Pepto Bismol, John is out playing golf or rock climbing if he’s not quite as intelligent about his hobbies as he is about his investing.

So now let’s say we come to the third year of the bull market. All the signs are there that the top is close. The Dow:gold ratio is approaching 1:1. Everyone and their cousins are buying gold coins. Moe has had a banner year and is up 30% (we are going to assume that Moe can spot the top and get out before losing all his profits) Roughly speaking Moe came away from the greastest bull market of our time with $660,000 after taxes and fees.

John on the other hand also had a banner year, his account was up another 200%. He now has $9,000,000. He incurs another $70-$100 in brokerage fees to sell his positions and a 15% tax on his capital gains which leaves him with $7,725,000.

Now let’s assume that Moe could some how match John’s buy and hold strategy by trading (he really can’t but I just want to make a point). The first year after taxes and broker fees Moe is left with $810,000. The second year after taxes and broker fees Moe’s portfolio has grown to $1,880,000. Finally after another banner year Moe is rewarded for all his time spent in front of his computer with a grand total of $4,340,000.

I’ve rounded the numbers and calculated taxes solely off the highest tax bracket so the actually numbers will be slightly higher but you get the picture. Trading as opposed to investing in this bull market is going to drastically reduce what one is going to make out of what will probably be the greatest opportunity any of us will ever see in our lifetime.

The loophole is there for anyone who wants to keep most of their profits. Or you can give away a big chunk of your earnings to the government. The same government, by the way, that destroyed our economy and will probably end up destroying our currency.

I got to say I’m leaning more towards letting the government fend for itself and keeping as much as possible."

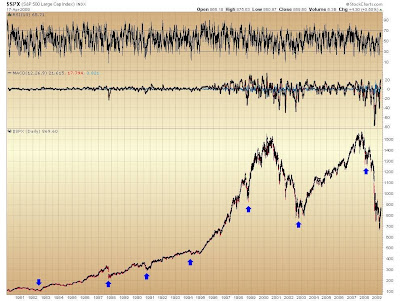

Or the shortest. For March to be the low and the end of the bear market it would also have to be a 4 year cycle low. I find that pretty unlikely and here's why.

Or the shortest. For March to be the low and the end of the bear market it would also have to be a 4 year cycle low. I find that pretty unlikely and here's why.

The 200 DMA of the daily cumulative tick is again at overbought levels that during this bear market have led to at least short term declines.

The 200 DMA of the daily cumulative tick is again at overbought levels that during this bear market have led to at least short term declines.

Historically a Gold:XAU ratio of 5 or higher has been a sign that mining stocks are too cheap.

Historically a Gold:XAU ratio of 5 or higher has been a sign that mining stocks are too cheap.