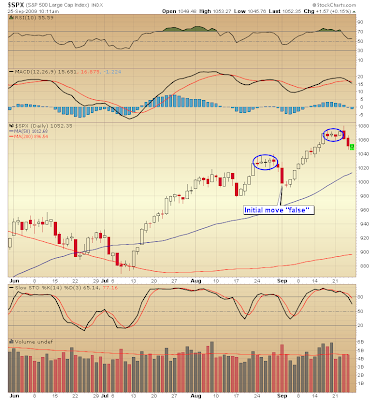

We may have the potential for another coil pattern unfolding on the S&P. Roughly 70% of the time when we see a volatility coil form the initial break from the coil proves to be a false move only to be followed by a more powerful and durable move in the other direction.

We saw a perfect example of this last month. The only caveat is that the current coil got a bit sloppy towards the end of the pattern so I'm not sure if we are really dealing with a true coil or not.

The heavy selling into strength we saw at the top suggested the market would break lower, which it has. Yesterday we saw the opposite and saw very large buying into weakness by institutional traders. So it appears the big money is looking for the pattern to repeat again.

Combine that with the runaway move stats and this correction shouldn't drop more than 35-50 points before reversing again. (If it does then we are probably dealing with a true intermediate correction and not just another fakeout)

I've also noted that if the S&P can close below 1040 we will likely have a Bollinger Band crash trade signal.