Here's something to think about. What if the market tests the 02 lows this month? Maybe even by next week the way this market is going. The S&P has already sliced through every conceivable support level. We are only about 150 points away. What if that's it for the bear?

What if the onslaught of paper money from the central banks around the world finally takes effect and we start to hyperinflate? That would mean a meteoric rise in stocks and more importantly commodities. Look at the chart of the 70's. Those rallies went up just as fast as they came down.

Now look at the charts of miners and energy companies. Both are holding up much better than the general markets. The miners more so than the energy stocks. Remember I've said in the past that the precious metals should out perform during the second (or third) leg of the secular bull market for commodities. Could the miners be setting up to lead the next bull?

In my previous post I noted that the dollar has likely made about all the gains we can expect from this counter trend rally unless it no longer is in a secular bear market. The powers that be are doing everything in their power to devalue the currency. Every central bank in the world is now on this path.

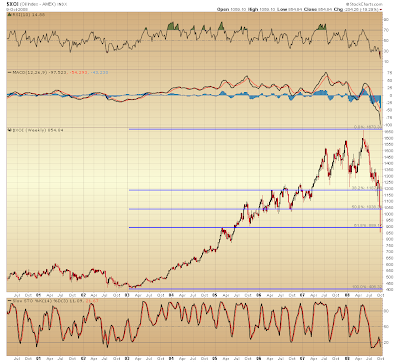

I want to point out a couple of of things on the gold chart. First off notice that Gold broke out above the 1980 highs back in the spring of this year. It then retraced 38% of the entire bull market. In the process it moved back below the $850 breakout level. Needles to say this scared the crap out of every gold bug in the world. I dare say very few have been able to hold on through this.

Now gold has broken through the $850 resistance level again. Tested that support, actually breaking back below it for two days, only to rocket higher again. The easy answer is that gold is a safe haven and everyone is flocking to it while the market crashes. I have to wonder if the easy answer is the correct one.

What if the powerful rise in gold has almost nothing to do with the stock market woes. What if gold is starting to discount the coming hyperinflationary future. Remember gold exploded higher by $88 dollars in one day. I'll tell you that from talking to my gold sources you just can't buy gold right now, everyone is sold out and silver, forget about it. You will wait for weeks to get silver. What little gold the dealers have is gone in seconds. Someone is buying all this gold and silver.

I've shown the Gold:XAU chart before. Unfortunately I can only get five charts on blogger so you will have to trust me on this one. The ratio of gold to the XAU is at extremes never seen in history. The miners are practically being given away. The start of the bull market in 2001 also saw the Gold:XAU ratio get stretched to historic extremes. Let me ask a question. How do bear markets end? They end of course in black pessimism. I think I can safely say that we have seen black pessimism in the precious metals sector, especially miners.

Do we remember how human nature operates? That's correct we go to extremes. We saw oil crushed to extreme lows in 06/07. What followed was what can only be called an amazing parabolic moon shot that ended with oil at $147. Now the miners have gotten crushed to the point where no one believes anymore. Hell, I've still got doubts myself. Not about the secular bull market mind you but on the timing of the next bull phase. What if my timing is off though? What if we are now seeing the beginnings of the third and final phase of the bull market in gold?

If so this is what's going to happen. The bull will recover quickly from a nasty decline. Check.

Fundamentals will support a renewed rally that very few will believe in as it gets underway. Check.

As gold breaks out to new highs smart money and nimble traders will jump on board. Somebody is buying a lot of gold. Tentative check.

At some point the general public will take notice. Once that happens we will have about 1 to 1 1/2 years of parabolic gains to look forward to.

The bull will end in a bubble completely unsupported by fundamentals. There will be a massive oversupply of gold but price will just continue to rocket upward. Everyone of your neighbors will be buying gold. The Dow:gold ratio will be at or near 1:1. That my friends will be the signal to sell your gold.

Could we be starting the third phase of the bull now?

What say ye?