Once something goes up long enough investors lose all fear and start to believe the move will never end. They start to look for reasons why this time will be different. They rationalize why there will be no correction. I saw it in spades last year as oil topped $147 a barrel. We saw it recently in the gold market as investors became convinced gold and mining stocks would not correct this time... even though miners were stretched 42% above the 200 DMA.

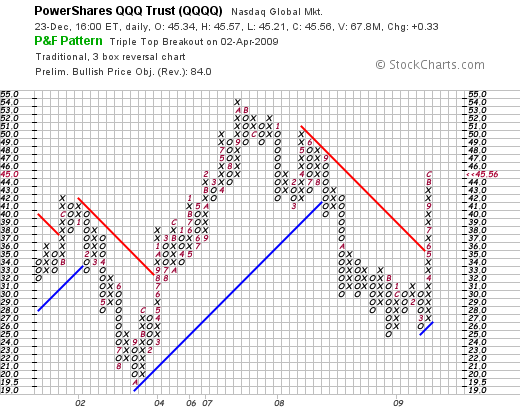

Here is a chart of the `04 top in the NDX.

Notice the parabolic move as everyone finally jumps on board. The five day RSI pushing into nosebleed territory. And the index stretched 20.3% above the 200 DMA. It was obvious to all that tech, the leader of the last bull market, was going to lead the economy out of the recession and there was no impending correction anywhere in the foreseeable future, right?

I've got news for you. All markets regress to the mean, all of them! It's like death and taxes. It's one of those things you can bet the farm on.

Ultimately the Nasdaq 100 dropped 17% into the August `04 bottom.

Investors are now back at it again.

Parabolic move? Check!

Oscillators extremely overbought? Check!

Market extremely stretched above the mean? Check!

Human nature never changes.