Flash Crash Ahead

15 hours ago

A financial blog on investing in stocks, commodities and the gold bull market.

I'm going to talk a little bit about inflation today but I'm going to come at it from a little different angle and try and show you how it affects everyone personally and why you should keep inflation in mind when you make investing decisions.

I'm going to talk a little bit about inflation today but I'm going to come at it from a little different angle and try and show you how it affects everyone personally and why you should keep inflation in mind when you make investing decisions.

I know many of you are familiar with my 5th year correction scenario. For any who are new to the site. All that means is that typically secular bull markets will have a serious counter trend decline somewhere around the 5th year of the bull market. The 87 crash is a great example. Last summer I think we saw that decline in the commodity markets. During the first phase energy and base metals outperformed precious metals and agriculture. During the second phase I fully expect PM and Ag to outperform. Notice how the correction in PM during this time was also milder than what took place in energy. During this next phase I think PM and ag is where an investor will outperform. These second phases can be rather long. The second phase in the stock market lasted from 87 to 98. During this time corrections should be bought not feared. Remember a correction is just the market doing something stupid. Your job is to take advantage of this stupidity.

I know many of you are familiar with my 5th year correction scenario. For any who are new to the site. All that means is that typically secular bull markets will have a serious counter trend decline somewhere around the 5th year of the bull market. The 87 crash is a great example. Last summer I think we saw that decline in the commodity markets. During the first phase energy and base metals outperformed precious metals and agriculture. During the second phase I fully expect PM and Ag to outperform. Notice how the correction in PM during this time was also milder than what took place in energy. During this next phase I think PM and ag is where an investor will outperform. These second phases can be rather long. The second phase in the stock market lasted from 87 to 98. During this time corrections should be bought not feared. Remember a correction is just the market doing something stupid. Your job is to take advantage of this stupidity.

I pointed out the runaway move in the S&P last year. These kind of moves are characterized by very uniform and minor corrections. It's beginning to look like the PM could be entering into a runaway type move. So far the corrections in gold have held at roughly $25 and in Platinum at $35-$40. If this trend continues then we should look for a correction that exceeds these parameters as a hint that the run is over. The two strong metals will most likely pull the weaker two (Silver & Palladium) higher with them. Both are too cheap and I expect liquidity to begin flowing into both.

I pointed out the runaway move in the S&P last year. These kind of moves are characterized by very uniform and minor corrections. It's beginning to look like the PM could be entering into a runaway type move. So far the corrections in gold have held at roughly $25 and in Platinum at $35-$40. If this trend continues then we should look for a correction that exceeds these parameters as a hint that the run is over. The two strong metals will most likely pull the weaker two (Silver & Palladium) higher with them. Both are too cheap and I expect liquidity to begin flowing into both.

I suppose many investors assume that the rise in commodity prices is a monetary phenomenon. However looking at gold and oil in Euros, Pounds and Yen we see they are both in strong bull markets even when measured in currencies that are appreciating strongly. The US is exacerbating the problem by printing too many dollars but the underlying cause is a supply/demand imbalance.

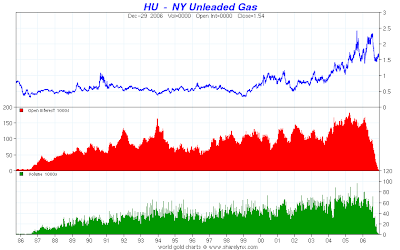

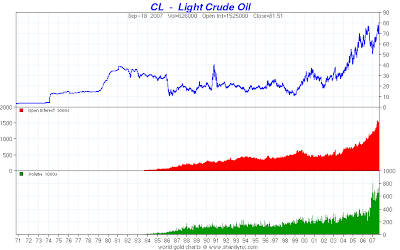

I suppose many investors assume that the rise in commodity prices is a monetary phenomenon. However looking at gold and oil in Euros, Pounds and Yen we see they are both in strong bull markets even when measured in currencies that are appreciating strongly. The US is exacerbating the problem by printing too many dollars but the underlying cause is a supply/demand imbalance. I'm going to point out again what I think will ultimately bring about a recession and it's not the housing melt down. I've posted in the past here and here about what I think the cause of recessions is. It is a spike in energy prices. As long as energy climbs in a controlled manner economies can adapt and survive higher energy prices. It's when they spike quickly that problems start to happen. If all of a sudden it costs two or three times as much to fill your car, heat your home or ship your products then bad things normally follow. Unless you have a really nice boss or can easily pass on the increase in energy costs to your customers then you are going to have to make some drastic changes in your life style during an energy spike. We all know how likely it is for your employer to boost your pay by 20% especially if he's feeling the pinch from the energy spike himself. Needless to say the extra money that was used for discretionary spending probably suffers during an energy shock. Since personal consumption is 70% of the economy it's not a good thing when a big chunk of this gets diverted to energy. Less consumption means less profits for business. Shrinking profits mean layoffs. Layoffs mean even less consumption. A vicious circle ensues. Notice the chart above. You will see a large spike in 79-80. Two recessions followed. Another spike during the first gulf war causing an immediate recession. Another spike in 99-2000. The bursting of the tech bubble and another recession followed. We are nearing the level at which things can get dicey. If we cross the $100 level this winter and especially if oil holds at this level I would say there's a very good chance we could see a recession sometime next year.

I'm going to point out again what I think will ultimately bring about a recession and it's not the housing melt down. I've posted in the past here and here about what I think the cause of recessions is. It is a spike in energy prices. As long as energy climbs in a controlled manner economies can adapt and survive higher energy prices. It's when they spike quickly that problems start to happen. If all of a sudden it costs two or three times as much to fill your car, heat your home or ship your products then bad things normally follow. Unless you have a really nice boss or can easily pass on the increase in energy costs to your customers then you are going to have to make some drastic changes in your life style during an energy spike. We all know how likely it is for your employer to boost your pay by 20% especially if he's feeling the pinch from the energy spike himself. Needless to say the extra money that was used for discretionary spending probably suffers during an energy shock. Since personal consumption is 70% of the economy it's not a good thing when a big chunk of this gets diverted to energy. Less consumption means less profits for business. Shrinking profits mean layoffs. Layoffs mean even less consumption. A vicious circle ensues. Notice the chart above. You will see a large spike in 79-80. Two recessions followed. Another spike during the first gulf war causing an immediate recession. Another spike in 99-2000. The bursting of the tech bubble and another recession followed. We are nearing the level at which things can get dicey. If we cross the $100 level this winter and especially if oil holds at this level I would say there's a very good chance we could see a recession sometime next year.

I'm posting the weekly charts of GLD and the XAU. Notice the only other time that GLD shot up like it did recently was during the final leg of the first phase in golds secular bull market. Now take a look at the XAU. It has never gone up like that. Some are suggesting that we are witnessing the final blowoff in this bull market. I guess it's possible. Anything is possible. However I'm going to point out another possibility. Perhaps something very significant in the investing environment recently changed. Gold is simply responding to that change. The Fed has decided to sacrifice the dollar in exchange for stimulating the economy. Gold is simply responding to the obvious that the Fed is now embarking on a rate cutting cycle. Will they cut at the next meeting? I don't know. The Fed funds futures say the probabilities are low for that in Oct. but who knows about the rest of the year. I don't see gold reversing this uptrend to any great extent until the Fed starts tightening again and I doubt that will happen at least till after next years elections.

I'm posting the weekly charts of GLD and the XAU. Notice the only other time that GLD shot up like it did recently was during the final leg of the first phase in golds secular bull market. Now take a look at the XAU. It has never gone up like that. Some are suggesting that we are witnessing the final blowoff in this bull market. I guess it's possible. Anything is possible. However I'm going to point out another possibility. Perhaps something very significant in the investing environment recently changed. Gold is simply responding to that change. The Fed has decided to sacrifice the dollar in exchange for stimulating the economy. Gold is simply responding to the obvious that the Fed is now embarking on a rate cutting cycle. Will they cut at the next meeting? I don't know. The Fed funds futures say the probabilities are low for that in Oct. but who knows about the rest of the year. I don't see gold reversing this uptrend to any great extent until the Fed starts tightening again and I doubt that will happen at least till after next years elections.

I'm going to point out a failed Sperandeo 1-2-3 reversal. I guess you could call this one a 1-2 continuation :) The test of the highs proved unsuccessful and so the trendline has now changed to a slightly lower angle and the trend has continued up instead of reversing. We now look like the HUI is on it's way to a technical rule #1 advance (A move followed by a sideways range often precedes another move of almost equal extent in the same direction as the original move. Generally, when the second move from the sideways range has run its course, a counter move approaching the sideways range may be expected).

I'm going to point out a failed Sperandeo 1-2-3 reversal. I guess you could call this one a 1-2 continuation :) The test of the highs proved unsuccessful and so the trendline has now changed to a slightly lower angle and the trend has continued up instead of reversing. We now look like the HUI is on it's way to a technical rule #1 advance (A move followed by a sideways range often precedes another move of almost equal extent in the same direction as the original move. Generally, when the second move from the sideways range has run its course, a counter move approaching the sideways range may be expected).

In bull markets you get abrupt nasty sell offs. We had one in Mar. and Aug. as an example. On the flip side in bear markets you get violent rallies when the market gets too oversold. We had several of those kind of rallies during the bursting of the Nasdaq bubble. The object is to figure out when we should be looking for one of these powerful rallies. In the S&P that level was 20% below the 200 DMA. Once that level was reached it was a good idea to cover shorts and wait for the inevitable rally before selling again. Well since I'm heavily invested in PM and they're influenced by the action in the dollar I want to know when I should be looking for a powerful rally in the buck. So far during this bear market that level has been around 8.5-10% below the 200 DMA. At the moment the dollar is about 5% below the 200 DMA. That would suggest that the dollar has a ways to go yet before we should look for a powerful rally. My guess earlier this month using other bear markets as an example was that the dollar could possibly sink to the 72-75 area in this second leg down. That should just about give us that 8-10% below the 200 DMA that I'm looking for before I want to sell any of my gold or silver positions.

In bull markets you get abrupt nasty sell offs. We had one in Mar. and Aug. as an example. On the flip side in bear markets you get violent rallies when the market gets too oversold. We had several of those kind of rallies during the bursting of the Nasdaq bubble. The object is to figure out when we should be looking for one of these powerful rallies. In the S&P that level was 20% below the 200 DMA. Once that level was reached it was a good idea to cover shorts and wait for the inevitable rally before selling again. Well since I'm heavily invested in PM and they're influenced by the action in the dollar I want to know when I should be looking for a powerful rally in the buck. So far during this bear market that level has been around 8.5-10% below the 200 DMA. At the moment the dollar is about 5% below the 200 DMA. That would suggest that the dollar has a ways to go yet before we should look for a powerful rally. My guess earlier this month using other bear markets as an example was that the dollar could possibly sink to the 72-75 area in this second leg down. That should just about give us that 8-10% below the 200 DMA that I'm looking for before I want to sell any of my gold or silver positions.

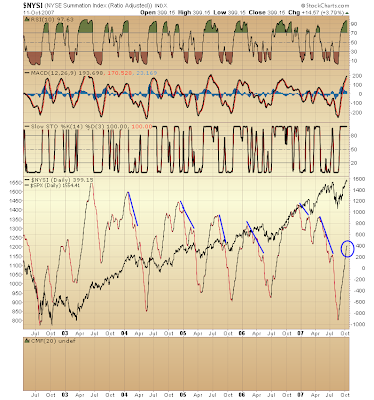

Today seemed like a very bad day didn't it? Many of the bears are again calling for the end of the world. The truth is however that no trendlines were broken today. That's not to say they won't be broken tomorrow or the next day but as of today nothing serious has happened. Also take a look at the summation index. Notice how almost all declines are preceded by a divergence in the index. At the moment there is no divergence as a matter of fact the SI was up today. We may get a little short term weakness, but as of today it hardly looks like we saw the beginings of a bear market yet.

Today seemed like a very bad day didn't it? Many of the bears are again calling for the end of the world. The truth is however that no trendlines were broken today. That's not to say they won't be broken tomorrow or the next day but as of today nothing serious has happened. Also take a look at the summation index. Notice how almost all declines are preceded by a divergence in the index. At the moment there is no divergence as a matter of fact the SI was up today. We may get a little short term weakness, but as of today it hardly looks like we saw the beginings of a bear market yet.

I got a request for a longer term chart of the gold/silver ratio. Ask and ye shall receive...hmmm I think I'll ask for silver to rise to $200 within the next 5 years :)

I got a request for a longer term chart of the gold/silver ratio. Ask and ye shall receive...hmmm I think I'll ask for silver to rise to $200 within the next 5 years :)

We all like to buy when something is on sale right? The common sense answer is of course we do. If you go to the store to buy a pair of jeans and one store is having a sale, half off, I think it's safe to say you're going to make your purchase at the store having the sale. The problem is that when it comes to investing common sense gets tossed right out the window. When investing we are drawn to the most expensive "jeans". Hell if they raise the price overnight on us that just makes us want those "jeans" even more. Take a look at those first two charts oil & copper. Pretty representative of what's been going on in energy and base metals during this bull market. Both are showing gains in the 700% range. Now take a look at Gold. A measly 200%. How about silver 250%. Copper and oil look much more appealing don't they?

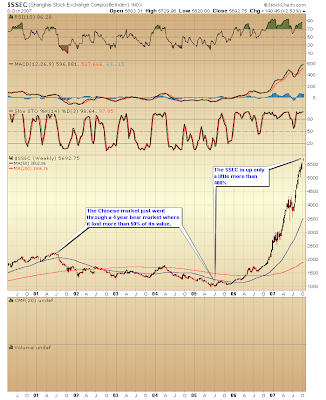

We all like to buy when something is on sale right? The common sense answer is of course we do. If you go to the store to buy a pair of jeans and one store is having a sale, half off, I think it's safe to say you're going to make your purchase at the store having the sale. The problem is that when it comes to investing common sense gets tossed right out the window. When investing we are drawn to the most expensive "jeans". Hell if they raise the price overnight on us that just makes us want those "jeans" even more. Take a look at those first two charts oil & copper. Pretty representative of what's been going on in energy and base metals during this bull market. Both are showing gains in the 700% range. Now take a look at Gold. A measly 200%. How about silver 250%. Copper and oil look much more appealing don't they? It seems that most investors think that China is in a bubble and it's ready to pop soon. Maybe it is and then again maybe it's not. First off notice from Mid 01 till 05 the Chinese market went through a devastating bear market . The SSEC lost more than half it's value. From that point the market has blasted off to a little over 400% gain. Impressive to say the least. But not all that unusual. Many secular bull markets can tack on 2000% before they're done. Look at the Nasdaq from 1980 to 2000. It gained 2000%. Granted the Chinese market has made those gains rather rapidly. I frequently hear about Chinese public piling into the markets as a sign of the end. However it usually takes about a year and a half of this kind of public participation before the market tops. Keep in mind the total population of China. The number of retail investors is still rather small compared to that huge population. I think I would hold out the possibility that China is exploding economically and there may be considerable upside yet before the inevitable correction comes. Of course it will come. When it does it's going to be one heck of a buying opportunity.

It seems that most investors think that China is in a bubble and it's ready to pop soon. Maybe it is and then again maybe it's not. First off notice from Mid 01 till 05 the Chinese market went through a devastating bear market . The SSEC lost more than half it's value. From that point the market has blasted off to a little over 400% gain. Impressive to say the least. But not all that unusual. Many secular bull markets can tack on 2000% before they're done. Look at the Nasdaq from 1980 to 2000. It gained 2000%. Granted the Chinese market has made those gains rather rapidly. I frequently hear about Chinese public piling into the markets as a sign of the end. However it usually takes about a year and a half of this kind of public participation before the market tops. Keep in mind the total population of China. The number of retail investors is still rather small compared to that huge population. I think I would hold out the possibility that China is exploding economically and there may be considerable upside yet before the inevitable correction comes. Of course it will come. When it does it's going to be one heck of a buying opportunity.

I'm starting to hear much ado about how there is too much bullish sentiment. This may or may not be true. At the end of a long bull market everybody is going to be bullish. The markets will have conditioned us to be bullish. Buying the dips will have been the motus operandi for years and human nature being what it is we will assume that strategy will now work into infinity. The thing is at the end of a huge bull market contrary opinion won't work. Everybody will be piling in. Occasionally a few will get scared and sell only to see the market rocket upward. They will then be forced to chase as they can't stand to miss out on any gains. The market will just keep rising no matter how lopsided the sentiment gets. Near as I can figure when we start to see this happen. When the public starts to catch on we've got about a year to a year and a half for it to suck in every last one of the sheep. During this time it's best to ignore all the contrary opinion polls. They're just not going to work as the markets get lost in an orgy of speculation and euphoria. Are we starting to enter this phase of the bull? I don't know but I do trust that the smart money is going to know when the end is coming and get me off the train in time. Just like they did in 2000.

I'm starting to hear much ado about how there is too much bullish sentiment. This may or may not be true. At the end of a long bull market everybody is going to be bullish. The markets will have conditioned us to be bullish. Buying the dips will have been the motus operandi for years and human nature being what it is we will assume that strategy will now work into infinity. The thing is at the end of a huge bull market contrary opinion won't work. Everybody will be piling in. Occasionally a few will get scared and sell only to see the market rocket upward. They will then be forced to chase as they can't stand to miss out on any gains. The market will just keep rising no matter how lopsided the sentiment gets. Near as I can figure when we start to see this happen. When the public starts to catch on we've got about a year to a year and a half for it to suck in every last one of the sheep. During this time it's best to ignore all the contrary opinion polls. They're just not going to work as the markets get lost in an orgy of speculation and euphoria. Are we starting to enter this phase of the bull? I don't know but I do trust that the smart money is going to know when the end is coming and get me off the train in time. Just like they did in 2000. It now appears that the transports are ready to breakout of the triangle on the flat side as tech rule #6 (Triangles of either slope may mean either accumulation or distribution depending on other considerations although triangles are usually broken on the flat side) would suggest is the greater possibility. While the transports haven't broken below the Aug. 16th lows they have been lagging. A break below the Aug. 16th low would have been a Dow Theory nonconfirmation and a possible warning sign. It is now starting to appear that possibility is becoming more and more remote.

It now appears that the transports are ready to breakout of the triangle on the flat side as tech rule #6 (Triangles of either slope may mean either accumulation or distribution depending on other considerations although triangles are usually broken on the flat side) would suggest is the greater possibility. While the transports haven't broken below the Aug. 16th lows they have been lagging. A break below the Aug. 16th low would have been a Dow Theory nonconfirmation and a possible warning sign. It is now starting to appear that possibility is becoming more and more remote. I checked recent history to see how many times the markets went through a 10% correction, rallied back to test the highs and then fell into another 10% or worse correction. This is the only one I could find in the last 27 years. Needless to say the odds are not good for the markets making a double top and then dropping below the Aug. lows.

I checked recent history to see how many times the markets went through a 10% correction, rallied back to test the highs and then fell into another 10% or worse correction. This is the only one I could find in the last 27 years. Needless to say the odds are not good for the markets making a double top and then dropping below the Aug. lows. I've posted this before but it's probably worth repeating. Final legs up in bull markets average 34% trough to peak in roughly 6 months. I've also noted that once the public starts to pile into an asset you can look for a parabolic move that lasts roughly 1 to 1 1/2 years. The Nasdaq bubble fit that criteria pretty closely. It lasted almost 1 1/2 years exactly. The real estate boom also lasted about a year and a half once the public caught on to a "sure thing". Notwithstanding last weeks COT, which may have been an aberration, the commercials are and have been at historic long positions. If we are entering this kind of period and you start hearing your neighbor and coworkers brag about how much they are making in the market keep in mind that at this stage of the game this is not a contrary signal. Far from it this means it is the time to be greedy as hell for about a year. Once that year is done then get rid of that greed at all costs and get the hell out.

I've posted this before but it's probably worth repeating. Final legs up in bull markets average 34% trough to peak in roughly 6 months. I've also noted that once the public starts to pile into an asset you can look for a parabolic move that lasts roughly 1 to 1 1/2 years. The Nasdaq bubble fit that criteria pretty closely. It lasted almost 1 1/2 years exactly. The real estate boom also lasted about a year and a half once the public caught on to a "sure thing". Notwithstanding last weeks COT, which may have been an aberration, the commercials are and have been at historic long positions. If we are entering this kind of period and you start hearing your neighbor and coworkers brag about how much they are making in the market keep in mind that at this stage of the game this is not a contrary signal. Far from it this means it is the time to be greedy as hell for about a year. Once that year is done then get rid of that greed at all costs and get the hell out.

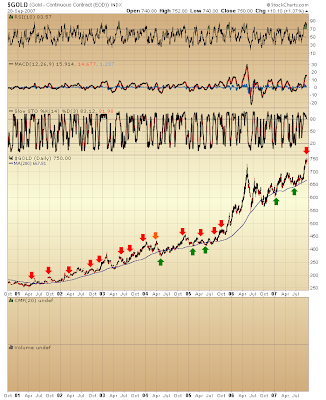

I'm going to show you COT sell/short signals in the gold market for the duration of this secular bull. Take note here as this is important. The commercials are much better at spotting value than they are timing tops. I've got news for you it's pretty much the same in every futures contract including the S&P's. Spotting tops is virtually impossible and the commercial traders aren't really any better at it than you and me. When I get a short signal I'm very hesitant about shorting and if I do it is in very small amounts. It is much safer to just go to cash and wait for the next long signal. We've got a short signal in gold right now but as we can see the history hasn't been great for calling tops. Even if we do get a pullback it's very unlikely to amount to much or last very long. So I won't be shorting or selling any of my PM. I may take a little off the table on my PM stocks because there is some pretty strong odds of some kind of pullback this month but I would never think of selling any of my physical gold or silver which is where most of my capital is anyway.

I'm going to show you COT sell/short signals in the gold market for the duration of this secular bull. Take note here as this is important. The commercials are much better at spotting value than they are timing tops. I've got news for you it's pretty much the same in every futures contract including the S&P's. Spotting tops is virtually impossible and the commercial traders aren't really any better at it than you and me. When I get a short signal I'm very hesitant about shorting and if I do it is in very small amounts. It is much safer to just go to cash and wait for the next long signal. We've got a short signal in gold right now but as we can see the history hasn't been great for calling tops. Even if we do get a pullback it's very unlikely to amount to much or last very long. So I won't be shorting or selling any of my PM. I may take a little off the table on my PM stocks because there is some pretty strong odds of some kind of pullback this month but I would never think of selling any of my physical gold or silver which is where most of my capital is anyway.